In many ways, Advanced Micro Devices (NASDAQ:AMD) has a tough task waiting in the wings – prove to the market that it has what it takes to carve out market share from the industry-dominating Nvidia.

Confident Investing Starts Here:

The market has been steadily warming up to AMD, and its share price has gained close to 50% since a post-Liberation Day low-point roughly two months ago. The shifting sentiment is a welcome change for investors, as AMD had been falling throughout the latter part of 2024 and during the first few months of the current year.

This follows a string of good news for the firm, including a strong Q1 2025 earnings report which contained record revenues of $7.4 billion and gross margins of 54%. A recently announced $10 billion partnership with a the Saudi Arabian HUMAIN didn’t exactly hurt matters either.

One top investor known by the pseudonym Stone Fox Capital thinks that the coming years could bring more good news – especially as the AI revolution progresses from training to inference.

“The AI inference market is set for explosive 80% CAGR growth, creating massive upside for a $500 billion AI accelerator market by 2028,” explains the 5-star investor, who is among the top 4% of TipRanks’ stock pros.

Stone Fox further details that AMD finds itself in a promising position to ride this growing market to healthy gains. For instance, the investor notes that if AMD manages to capture just 10% to 20% of the AI accelerator market, its data center revenues could range between $50 to $100 billion by 2028.

“The key to the AMD investment story is that the company actually enters mid-2025 with limited data center sales in comparison to the opportunity ahead,” adds Stone Fox.

The investor emphasizes that AMD’s MI355x is coming online at just the right moment, as it presents a big step forward from the MI300x. Stone Fox even notes that the company has suggested that the MI355x will be able to generate up to 40% more tokens per dollar than Nvidia’s B200 GPU.

In other words, things could be taking off for AMD.

“AMD has an opportunity to become a monster in the AI inference market after lagging in the AI training segment,” concludes Stone Fox, who is rating AMD a Strong Buy. (To watch Stone Fox Capital’s track record, click here)

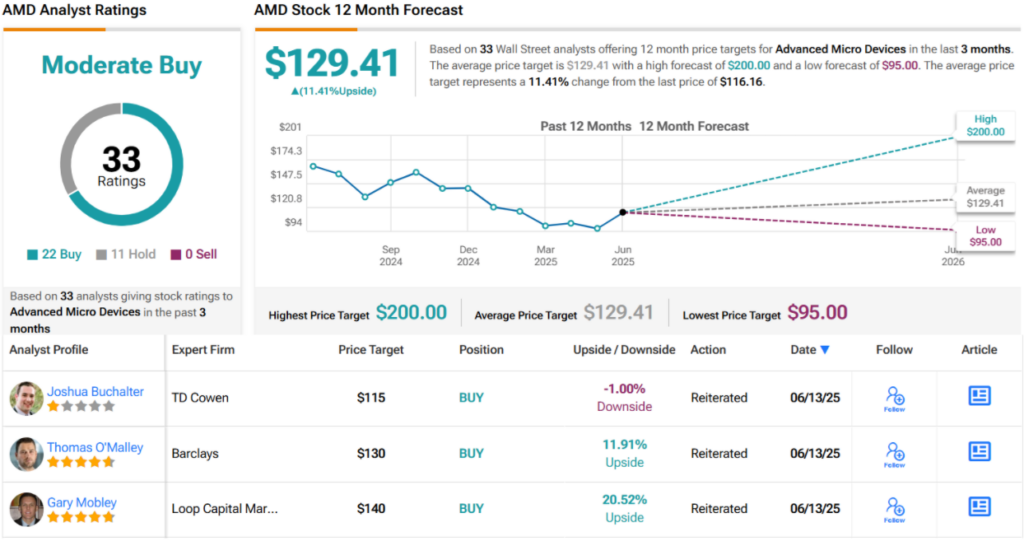

Wall Street is also feeling positive about AMD’s prospects. With 22 Buy and 11 Hold ratings, AMD enjoys a Moderate Buy consensus rating. Its 12-month average price target of $129.41 has an upside of ~11%. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks’

Best Online Brokers

guide, and find the ideal broker for your trades.